Navigation

Newsletter Subscription

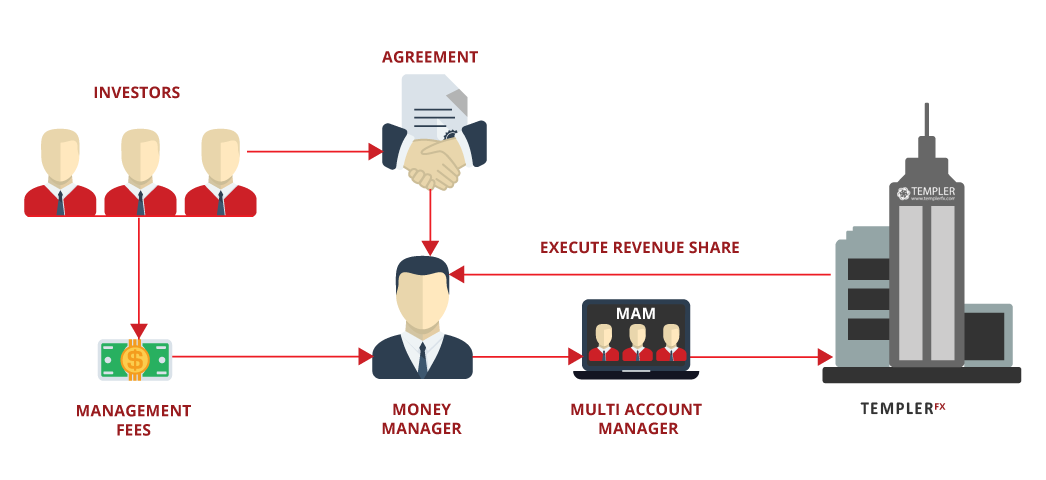

Money Managers

SERVICING FX MONEY MANAGERS

| If you are a licensed Money Manager in a country, where you are residing and searching for alternative investment vehicles, you may want to look at FX and CFD products. Unlike managing traditional equities and futures portfolio, investing in FX and CFDs allows a Money Manager to utilize a greater leverage and abilities to go long and short at the same time. Additionally, a tremendous liquidity of the FX market and 24/5 operation enables a money manager to trade around a clock. |  |

METATRADER 4 MULTI-ACCOUNT MANAGER (MAM)

Attention Money Managers! Your life just got a whole lot easier.

Gone are the days of keeping 20 trading platforms open at the same time. When you’re trying to buy USD/JPY and you have to do it in 20 accounts, it takes several minutes to place the trade for all your clients. That kind of poor execution is terrible for you and your customers.

The MAM saves you time and effort by bringing all of your trading accounts under a single umbrella. You can manage all of customer orders from one charting platform. Your next big order will be done with 2 mouse clicks instead of 60.

- Manage unlimited customer accounts from one open instance

- Full charts, reporting history and everything you expect to find with MetaTrader 4

- Supports full, mini and micro lots for maximum precision with your position sizing

Advantages of TEMPLERFX MAM

- Fully automated Service

- Distinguished and Dedicated Support per Fund manager

- All Allocation Methods known to man kind

- Flexible profit Sharing and Trading Environment

- Reliable Platform with Highly competitive Trading Costs

- No Transaction costs

- $1 000 USD minimal starting level

- Fast Deposits and Withdrawals

- No limit as per number of sub-accounts

- Fast processing time and MAM Linkage

- EA Trading is allowed

- Micro lots available

How the TEMPLERFX MAM works

You have a total of one million dollars under management.

- Investor A has a balance of $500,000

- Investor B has a balance of $400,000

- Investor C has a balance of $100,000

The profits and losses of each trade are split between the investors based on their account’s equity as a percentage of the total under management.

- Investor A gets 50%

- Investor B gets 40%

- Investor C get 10%

Example

You make a small trade that earns of profit of $10,000.

- Investor A gets $5,000

- Investor B gets $4,000

- Investor C gets $1,000

Losing trades work in the same way. If there was a $10,000 loss, then each individual investor’s loss would be their pro-rata share $10,000.

Speak to one of our experienced account managers today to find out more about setting your MAM account.

Email: support@templerfx.com